Property Taxes, Trash Collection Fees and our local Government Office

- Mark Tedesco

- May 25, 2025

- 5 min read

PART 142: It might be interesting to share how we pulled off living in Italy for part of the year. I will post some steps and what we are learning along the way.

We love every minute of it, and what was once a dream is our life!

We live in Tuscany in the Fall, then back again in the Spring, and in California for the rest of the time (in a previous blog, I explained why we live in Italy only part of the year).

Step 1: As we explore areas in Italy, we discover some gems worth sharing. Some are well-known tourist magnets, and others are lesser-known but always amazing.

This week, let's stay in town and visit our local government offices to find out how to pay the property taxes (IMU) on our home and for garbage collection.

Step 2: What is IMU?

The Italian Municipal Property Tax (IMU) is a wealth tax imposed on immovable property, including buildings, building areas, and agricultural land.

IMU stands for Imposta Municipale Unica, meaning "Unique Municipal Tax." This property tax applies when an individual possesses or owns real estate. It is levied on residential, commercial, and land properties. Each co-owner's tax amount is calculated based on the months they owned the property throughout the year. It is determined according to the property's cadastral value, as recorded in the building register.

Unlike in other countries, homeowners in Italy will not receive a bill or reminder from their municipality regarding IMU payments. Therefore, it is the homeowner's responsibility to calculate and pay the applicable IMU amount annually.

IMU EXEMPTION: Because IMU is a tax on second homes, primary residences are exempt – unless they are luxury properties categorized as A1, A8, or A9 in the land registry.

IMU is categorized as a local tax, meaning that each municipality can impose an additional tax rate on top of the standard national rate, following specific parameters set by law each year. As a result, the IMU amount due for similar properties can differ from one municipality to another and from year to year.

To calculate the IMU, the following information is required:

1. The property's taxable value and any outbuildings, such as garages, parking spaces, or cellars (rendita catastale).

2. The category type: A is for residential properties, while C is for accessory buildings (e.g., garage as C6 or storage room as C2).

3. The current IMU tax rate (aliquota) applied by the municipality where the property is located.

4. The cadastral coefficient values for each cadastral category.

Don't worry: I will explain more about this below.

Step 3: What are the garbage collection fees?

Since we live in the historical center, we take our garbage down the hill to dispose of it in four separate bins, depending on the type of trash. After registering the house in our name, we received a plastic card that, when placed against a sensor on each bin, unlocks the lid for depositing our waste.

While we were in Puglia, where we lived outside the historical center, trash was collected right in front of our house, so we didn't need to access neighborhood garbage bins. Our landlord paid the garbage bills for us.

Now that we have purchased a house in Tuscany, we can't rely on a landlord to pay our garbage fees.

We wanted to ensure that we didn't fall behind on our trash disposal bills, so we visited our local government office.

Step 4: Our visit to the local government office (Comune)

We noticed a sign reading "Comune" posted outside a majestic historical building in the center of our town. Unsure of where to go for information on IMU payments or trash collection fees, it seemed like a logical place to start.

We walked in without an appointment and explained our needs to the attendant, who directed us to the appropriate office upstairs.

Since it was just before lunchtime, the building was mostly deserted. We didn't find anyone in the upstairs office, so we waited until someone arrived and asked how they could assist us.

A few minutes later, we were taken to the correct office, where the official on duty paused his work and kindly explained how to pay the IMU and garbage collection fees.

Step 5: Paying the IMU

The local government does not send out property tax bills; instead, it is the homeowner's responsibility to visit their bank and arrange payment. Although the Comune provided me with the formula for calculating the tax amount, I remained confused. He even recommended an app that calculates one's IMU, but I decided I needed more clarity.

I spoke with other expats whose accountants ("commercialista") handle their IMU payments. Consequently, I contacted our excellent realtor, who referred us to a reliable accountant. For a small fee, this accountant helps manage the payment of our IMU directly from my Italian bank account.

We found the property tax and garbage collection fees to be much lower than in California.

No more confusion about the IMU!

Step 6: Paying the garbage fees

"But," I said to our local government official, "what if we fall behind on the garbage fees? We will be in California when some of the bills arrive. Can we get a bill emailed and then pay online?"

He reassured us that there would be no problem, even though online billing and payments were not possible. He suggested that when we are in town during the Spring and Fall, we could come down to his office to find out what we owed, or arrange payment. Alternatively, he mentioned that we could simply email him and then go to our bank to have it paid.

He made it very straightforward and assured us that a late payment due to being out of town would not be held against us.

Insights:

I don't know if all local government offices in Italy provide the same level of personal attention and patience we experience in Arcidosso. However, managing taxes, energy bills, and sanitation fees has become significantly easier here. The professionalism and willingness of the staff to guide us through the processes, along with their availability for questions and clarifications, is something I have never encountered in any other government office. Anywhere.

When we went to our local bank (Intesa San Paolo) to pay the fees, the process was completely smooth and it only took a few minutes.

We are so grateful.

More next time.

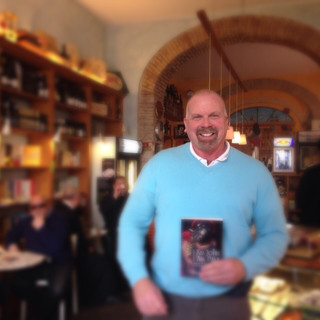

My new novel is on sale now for $2.99! "Onward: A Life on a Sailboat" is a tale that will draw the reader to the Amalfi coast, the deserts of Algeria, the south of France, and beyond. https://a.co/d/3hhJkxE

Amazon Italy- my book "Lei mi ha sedotto. Una storia d'amore con Roma": https://amzn.eu/d/13nuZCL.

Interesting..... For us, our realtor arranged for all bills to be taken automatically out of our Italian bank account. I hope that it is happening as it all is very confusing..... We chose to become residents so that we didn't have to pay the "sales tax" on the purchase of our property, which was a significant amount. Also, we didn't want the hassle of having to pay the IMU. But the negative is that once you get residency, you have 1 year to get an Italian driver's license (all tests in Italian)! So that will be the next step.